By Ellis & Company | January 29, 2021 | Tax Documents

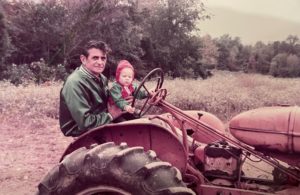

There were a lot of rocks in Pawpaw’s garden. They had to go or plants wouldn’t grow. My brother and I were perfect for the job. It was a pretty big garden, nearly the size of a football field, and it usually took us about a week to clear all the rocks. This was hard work for a ten-year-old.

Over 5 summers, we became seasoned garden-rock-picker-uppers. One day my brother had an idea. If we buried the rocks, we didn’t have to pick them up. Genius! We finished in record time that year! Well, this wasn’t Pawpaw’s first rodeo. “Already?” he said, as he leaned back, raised his chin, and squinted his eyes. We walked out to the garden together to check our work. “Looks pretty good” Pawpaw said casually. Next, he walked over to the barn and grabbed the garden hose. He started to spray, slowly revealing the small piles of rocks. “Looks like you have some more work to do.”, he said. We spent the next 3 days finishing the job. It was important to him we did things the right way.

What does this have to do with filing your taxes? You want your tax filing completed as quickly as possible. We get it. Just pull the Band-Aid off in one quick stroke. My brother and I learned in Pawpaw’s garden, quick don’t always mean wise. Having to make an amendment to your tax return can be frustrating, take more time, and leave you questioning yourself. Did I do this right?

We don’t want you feeling this way. You deserve to have comfort and peace of mind.

Be Patient

Give yourself enough time for your documents to arrive. Sometimes tax documents can be delayed. In some instances, there may be corrections to tax documents. You want to get your tax filing completed with the correct information. Some extra patience can go a long way. This can give you enough time to receive the correct documents. I wish my brother and I were more patient picking up those rocks. He and I paid the price for rushing through. We don’t want you to find yourself in the same situation. Submitting your tax return after February 15th or after may be a good idea.

Gathering Your Documents

One of the challenges is knowing if you have all of the documents you’ll need. Check with your CPA or tax preparer, many times they will have a checklist to help ensure you have all of your documents. There are a several scenarios that could produce tax documents. If you have/had a retirement account and made a withdrawal in 2020 you should expect a tax document. If you transferred and/or rolled over a retirement account in 2020 this will produce two tax documents. You’ll receive one from the company you transferred your assets from and a separate document from the company you transferred your assets to. If you have/had a taxable account in 2020, this will likely result in a tax document as well. These are just a few scenarios. There are other situations that would cause you to receive tax documents too.

Where do I find my tax documents?

- Via Mail – Most traditional way to receive tax documents.

- Online – You can login to your account through Client Access and find your tax documents in the document section.

Most tax documents will be sent via mail and online access by Feb. 15th, 2021. There is a small chance your tax documents may be a delayed. If this happens, you’ll receive a notification from Raymond James and communication from our team. In some rare instances, documents may be delayed as late as March 15th.

Know Your Contacts

Jessika Appleton is the best person for you to contact with your general questions about your Raymond James tax documents. Call Jessika at our office (931) 905-0050 or you can email her, jessika@retireconfident.com. Jessika can help with what documents to expect and if they are ready yet. Your CPA or tax preparer will be the best contact with specific tax questions about how these documents will affect your tax filing.

Retire Confident,

Eric Ellis

Financial Advisor

Ellis & Company Retirement Strategists

931.905.0050

931.905.0050