By Eric Ellis | February 1, 2021, | Qualified Charitable Distribution

Last Christmas my wife and I were wrapping presents for our family when she burst out loud laughing.

“What? Am I doing it wrong?” I asked confused. I don’t know if you’ve ever been laughed at like this but it hurt. “Is that how you’ve always wrapped presents?” she asked. I clearly didn’t know what I was doing. Next thing you know, she took me to school on how to properly wrap a present and I’m thankful she did. I was wasting paper, it took too long, and it could certainly look better. After some practice, I was a pro!

Just as I didn’t realize there was a better way to wrap presents, there are more efficient ways to gift to charities. One of those ways is through your IRA. A qualified charitable distribution (QCD) could save you money in taxes, simplify how you give, and empower you to be more generous.

Giving With Greater Benefits

Save You Money

A qualified charitable distribution (QCD) is one of the most tax-efficient ways of giving. You can donate up to $100,000 directly from an IRA to a charity of your choice without getting taxed, as long as you are 70 1/2 or older with a QCD. Additionally, it can be used to meet your required minimum distribution (RMD). For those in a high tax bracket the QCD is a useful way of removing an otherwise taxable RMD from being added as income on your tax return. Less money in taxes means more money in your pocket.

Simplify Your Gifting

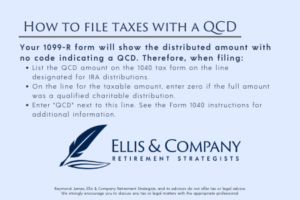

You would normally have to itemize your tax returns to accomplish the same tax advantage. The challenge is most people do not itemize. Even for those who do, it means keeping track of countless receipts and documents for your tax filing. This can be tedious and a challenge to track over the year and you need to keep them for several years in case there is an audit. The QCD is a lot easier. You’ll receive your standard 1099-R then inform your tax professional about your gift. If you file your own taxes some additional guidance is below.

More to Give

Any funds you withdrawal from your IRA are taxed as ordinary income. Depending upon where you fall on the tax bracket this rate could be as high as 37%. With a QCD, the amount you gift avoids income tax. Leaving you with more money to donate. For example, $25,000 is reduced to $15,750 with a 37% tax rate. Donating through a QCD, you avoid income tax, $9,250 ($25,000 – $15,750) in this example leaving you with $9,250 more to gift. Additionally when you use a QCD, your RMD amount is excluded from tax formulas that could impact items like Social Security, Medicare Part B, and D premium increases, and the Medicare tax on investment income.

How It Works

It’s easy like Sunday Morning. We will send your QCD directly to the qualified charity you’ve chosen. The organization must meet some requirements and there are some exclusions.¹ Your QCD must be eligible for a full deduction. You cannot make a partial deduction with a qualified charitable distribution. The charitable organization must receive the donation by December 31.

If you have already taken your RMD for the year, unfortunately, you cannot reclassify or reapply it as a QCD. Additionally, a qualified charitable distribution is not available in active SEP-IRA and SIMPLE IRAs that you are still contributing to through your employer.

When Not To

High Donations

If you donate more than your standard deduction you may see more advantages by donating from taxable assets and itemizing. Consult your tax professional to determine whether this is best for your situation.

Gifting Highly Appreciated Positions

If you have a highly appreciated position (typically stock) in a non-retirement account and you wish to gift it, there is a more advantageous way to accomplish this. Gifting the stock directly removes the taxation of the gain from you and it also provides the ability to claim a tax deduction against your income. The QCD only removes the RMD amount from taxation.

Roth IRAs

While a QCD can be done from a Roth IRA, this is generally not advisable since most distributions will not be taxed anyhow.

Above all, you are one-of-a-kind, so is your financial and tax planning. It is very important to seek guidance from a trusted professional to explore if this tax-planning idea is right for you.

With my newly learned wrapping skills, I can now wrap with the best of them. My wife no longer laughs at me, well at least not for this… Hopefully, with the information in this article, you can have the confidence that you are giving in the best way you can. It could save you money, simplify your taxes, and allow you to be more generous.

Retire Confident,

Eric Ellis

Financial Advisor

Ellis & Company Retirement Strategists

931.905.0050

931.905.0050