By Kathy Ellis, CFP® Professional | January 1, 2024 | New IRA Limits for 2024

You can now add more to your IRA for 2024.

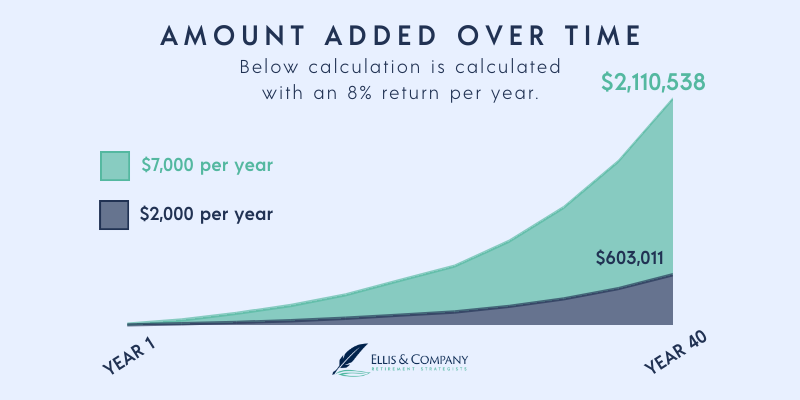

New limit: $7,000 is now the maximum per year per individual for Traditional IRAs and Roth IRAs per the Internal Revenue Service (IRS). The new contribution limits for Individual Retirement Accounts (IRAs) begins January 1, 2024.

50 or Older? You can add an additional $1,000 per year. So you can add up to $8,000 in 2024 if your 50th birthday is on or before December 31, 2024.

Why it matters: This provides an opportunity to boost your retirement savings and help secure a more financially comfortable future. In this article, we’ll explore the new limits, the reasons behind the adjustments, and how these changes can benefit your retirement planning.

The IRS adjusts IRA contribution limits periodically to account for inflation and changes in the cost of living. The last increase came in 2023 when the limit was raised to $6,500 from $6,000. These adjustments aim to ensure that retirement savers can maintain the purchasing power of their contributions over time. The increase in contribution limits is a good news, especially given the rising costs of living and the need for individuals to save more for retirement.

Benefits

Less Taxes: Contributions to Traditional IRAs are typically tax-deductible, while Roth IRA contributions are made with after-tax dollars but offer tax-free withdrawals in retirement. By contributing more to your IRA, you can potentially reduce your current tax liability or enjoy tax-free income in retirement.

More for Later: Higher contribution limits allow you to invest more in your IRAs each year. This can lead to more substantial retirement savings over time. This can be especially beneficial for younger people because of how higher contribution amounts compound over time. The earlier and more you add, the more time your investments have to grow, potentially leading to significant gains over the long term.

Flexibility: The increased contribution limits provide greater flexibility for retirement planning. When the time comes you need to use your retirement savings the more you add the more options you’ll have. Would you rather have more or less options? During retirement you’ll want more. This gives you an advantage so you can go with what best aligns with your financial goals and circumstances.

The big picture: Being able to add more to your IRA is a good news. These changes offer individuals the opportunity to save more for retirement, take advantage of tax benefits, and help secure a more financially comfortable future. Whether you opt for a Traditional or Roth IRA, the increased limits provide a pathway to building a more robust retirement nest egg.

As always, consult with your CERTIFIED FINANICAL PLANNER™ professional or your CPA/tax professional to determine the best strategy for your specific financial situation and retirement goals.

Retire Confident,

Source: IRA limit rises to $7,000 per IRS.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available date necessary for making an investment decision and does not constitute a recommendation.

The opinions expressed here are those of Ellis and Company and not necessarily those of Raymond James. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All investing involves risks, including the possible loss of the principal amount invested. No investment strategy can guarantee your objectives will be met.

Ellis & Company Retirement Strategists, Kathy Ellis, CFP® professional CERTIFIED FINANCIAL PLANNER™, Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Raymond James, Ellis & Company Retirement Strategists, and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Kathy Ellis & Eric Ellis are Investment Adviser Representatives meaning they are fiduciaries on fee-based accounts.

The chart is a hypothetical example for illustration purpose only and does not represent an actual investment.

931.905.0050

931.905.0050